Co-investments for funds have become so sought after that most fund managers charge investors for fees and carry on those investments, according to the 2020-21 PE/VC Partnership Agreements Study published by Buyouts.

Of the 98 North American buyout and venture managers surveyed, over half charged for co-investing (59 percent), though some of those firms only ask for fees and carry from non-LPs. These buyout and venture managers waive fees and carry 34 percent and 37 percent of the time, respectively.

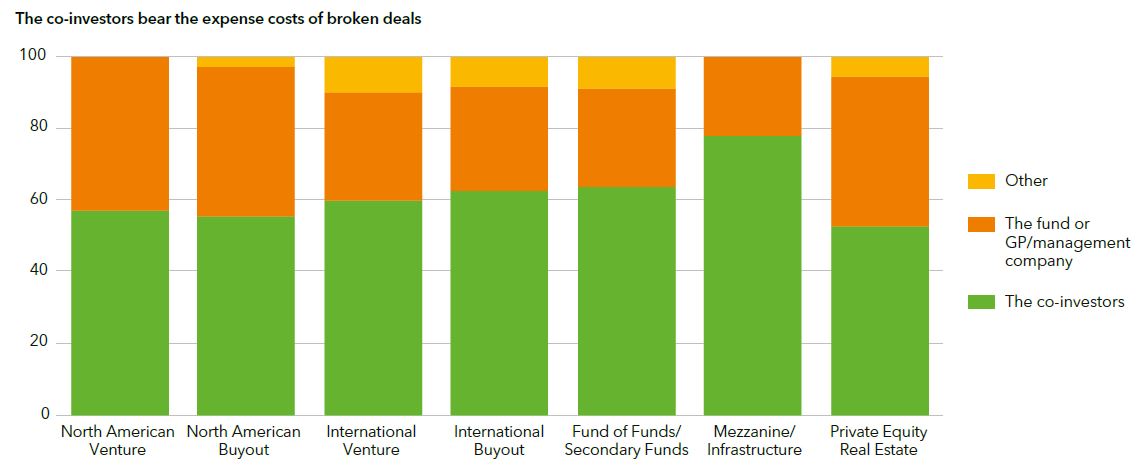

Investors who enter the fund through co-investments could potentially face a heavy cost burden. Most funds across all asset classes surveyed in the PE/VC Partnership Agreements Study said that the co-investors will bear the expenses of a broken deal.

Find out about the full 2020-2021 Private Equity/Venture Capital Partnership Agreement Study here.

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: