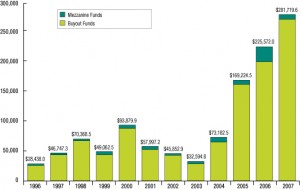

Nowhere was the confidence of general partners in dealmaking opportunities so on display as in the sea of multi-billion-dollar targeted funds brought to market. Nowhere was the confidence of investors seen so much as in the flood of new investors to the scene and the ratcheting upward of allocation targets to private equity. U.S.-based buyout firms absolutely smashed last year’s total—itself a record—of $225.6 billion raised. This year, buyout shops amassed $276.7 billion in commitments from limited partners. Mezzanine funds added another $5.0 billion.

Once again, it was the mega-funds that raised the lion’s share of the total. Buyout funds with targets above $5 billion with headquarters in the United States convinced LPs to sign up for $135.1 billion in commitments. The next rung down, funds with targets of between $1 billion and $5 billion generated $89.3 billion in commitments. Funds with targets of between $300 million and $1 billion tallied $22.7 billion, while funds with targets of less than $300 million scraped together $6.4 billion. (Added up, these totals fall just short of our grand total of $276.7 billion because not all funds that we track have known targets. See table on p. TK).

LPs, meanwhile, kept pouring in droves into the market. Relative newcomers to the asset class included Arizona State Retirement System (which has carved out a 5 percent allocation to private equity); Public Employees’ Retirement System of Mississippi (5 percent); South Carolina Retirement System (5 percent); Vermont Pension Investment Committee (up to 3 percent); and West Virginia Investment Management Board (5 percent). Several others boosted their allocations to private equity. Indiana Public Employees’ Retirement Fund moved from a 4 percent target allocation to 8 percent, while Louisiana State Employees’ Retirement System rose from 5 percent to 10 percent, and Missouri State Employees’ Retirement System raised its target allocation to 7.5 percent from 5 percent. Wealthy investors showed up to the party, many investing through feeder funds earmarked for a single large buyout fund. Altogether Buyouts has identified seven feeder funds raised since 2005, accounting for some $1.9 billion altogether.

The year also saw the purchase of stakes in GPs by massive sovereign funds, which are expected to be ongoing sources of capital. They include the Chinese government’s $3 billion stake taken in New York’s The Blackstone Group, and Abu Dhabi’s purchase of a 7.5 percent stake in The Carlyle Group, based in Washington, D.C., for $1.35 billion. The Abu Dhabi Investment Authority paid $375 million for an estimated 15 percent stake in Los Angeles-based Ares Management.

Here’s a quick tour of the year’s highlights in fundraising:

• Blackstone, after years in the market, closed the largest buyout fund of all time at $21.7 billion. At least one placement agent observed that the event, taking place around the same time as its summer IPO, could mark the peak of the LBO market. “It was almost as if Steve Schwartzman had a crystal ball,” said Kelly DePonte, a Partner with San Francisco-based placement agency Probitas Partners. The firm is expected in the market shortly with its next fund, targeting anywhere between $15 billion and $25 billion.

• GS Capital Partners, the New York-headquartered buyout arm of Goldman Sachs, kept its momentum a year after closing massive mezzanine and infrastructure funds. It closed its ts latest global buyout fund, Goldman Sachs Capital Partners VI, at $20 billion, which for a short time held the title of largest buyout fund ever raised.

• Sun Capital Partners, a Boca Raton, Fla.-based shop with a penchant for turnaround investing, rattled off a rapid fundraise early in the year, amassing $6 billion, exceeding a $4 billion target. Providence Equity Partners, the Providence-based communications, media and entertainment shop, did likewise, checking in briefly with limited partners to stockpile an additional $12.1 billion.

• A number of firms with roots in the distressed industry amassed huge funds, amid ample talk of the next distressed cycle hitting. These include the $7.5 billion Cerberus Institutional Partners LP Series IV; the $5.75 billion Cargill Inc.-backed CVI Global Value Fund; and the $5 billion MatlinPatterson Global Opportunities Fund III.

• Thomas H. Lee Partners, a generalist buyout shop with its head office in Boston, at last overcame the stigma of bankrupt portfolio company Refco Inc. to close its $8.1 billion sixth fund after more than two years in the market. It also closed a $2 billion co-investment fund.

• New York-based Kohlberg Kravis Roberts & Co., in the midst of an IPO that may never happen, kept its KKR 2006 Fund open, which, last we checked, had $18.5 billion raised.

• A number of mega-firms returned to market targeting huge amounts, including Apollo Investment Fund VII, targeting a reported $15 billion; Bain Capital Fund X, targeting $10 billion, plus a $5 billion co-investment fund; Carlyle Partners V, a North American-focused buyout fund with a target of $15 billion; Madison Dearborn Partners VI, in pre-marketing with a target of $12 billion; and Warburg Pincus Private Equity X, targeting $15 billion.

• In the middle market, New York turnaround investor KPS Capital and San Francisco’s Genstar Capital were able to move to 25 percent carried interests, thanks to immense demand among LPs.

Of course, not everyone had success on the fundraising trail in 2007. Emerging managers faced an uphill race where only a fraction reached the finish line. Among these smaller funds, the song remains the same from the LP community: Show me a track record, show me industry expertise, and I’ll show you the cash.

Case in point is El Segundo, Calif..-based Marlin Equity Partners, a spinout from The Gores Group that invests in technology and health care. The firm closed on its $300 million hard cap this fall after raising a starter fund of $60 million in 2005. Marlin Equity Partners Director Peter Spasov told Buyouts, “We found LPs wanted to increase exposure to special situations and operational expertise.” LPs in its fund, placed by Probitas Partners, included Columbia University, Goldman Sachs, the state of Kentucky, the Robert Wood Johnson Foundation and University of Virginia.

Another emerging manager to raise money in 2007 was Mainsail Partners, a technology-focused LBO group founded by former Summit Partners pros Jason Payne and Gavin Turner. The firm closed its first fund with $33 million in 2005, and its latest brought in $100 million. Payne told Buyouts that the strategy of the San Francisco-based firm is “to take the original Summit Partners cold-call model and apply it to the low end of the market.” The new fund drew commitments from Oregon Investment Council, via Grove Street Advisors, and from Sacramento Private Equity Partners, a year-old $500 million fund managed by Oak Hill Investment Management on behalf of the California Public Employees’ Retirement System.

Two of the most popular fund categories last year were infrastructure and energy.

Among infrastructure funds raised last year were the $721 million Carlyle infrastructure Partners; the $110 million Starwood Energy Infrastructure Fund; the $3 billion Alinda Infrastructure Fund I; and the $1.5 billion Morgan Stanley Infrastructure Fund. Long-time Australian infrastructure investor Macquarie also raised several infrastructure funds targeting different regions across the world.

Interest among LPs in infrastructure is likely to remain high. CalPERS carved out a new asset class, called “inflation-linked assets,” in which it is grouping infrastructure and real estate investments. The LP’s proposed total allocation to inflation-linked assets is $2.5 billion. Meanwhile, Washington State Investment Board carved out a five percent allocation for “tangible assets” and Oregon State Treasury is dabbling in the infrastructure market through an “opportunity fund.”

Buyouts also tracked more than a dozen energy funds raising more than $13 billion in 2007. Among the top energy-focussed fundraisers were East Brunswick, N.J.-based LS Power’s LS Power Equity Partners II, which closed on $3.085 billion this past year, and Houston’s EnCap Investments’s EnCap Energy Capital Fund VII, which closed on $2.5 billion.

Looking Ahead

What impact the credit crunch that began this summer will have on the fundraising market remains to be seen. The consensus among Buyouts sources is that while the credit crunch encouraged LPs to check their exuberance, returns for buyout funds, especially mega-funds, have yet to dip. And few LPs will be scaling back until they do.

To be sure, a prolonged dry spell for mega-deals will almost certainly slow the fundraising market as buyout firms invest money more slowly. Moreover, George Gaines, a partner with placement agency BerchWood Partners, said the credit crunch could leave LPs more tentative. “The credit crisis didn’t immediately affect fundraising. But I do think that moving into the fourth quarter there was increased caution towards mega-funds, since they won’t be able to invest as quickly. In 2008, limited partners are probably going to stand pat at current allocations to mega-funds.” Gaines suggested that money that might have flowed to mega-funds will be redirected elsewhere within the private equity industry, towards secondary funds, expansion capital, mezzanine and infrastructure funds—alternatives within an alternative asset class.

That said, Mac Hofeditz, a placement agent at Probitas Partners, said “Most LPs have a core set of relationships that are coming back to market, and they seem to be re-upping without regard for current market conditions.”

Indeed, the end of the year, by at least one account, ended on an upswing. Tim Kelly, a managing director with Adams Street Partners, a fund-of-funds manager that backs funds of every size, said things were actually picking up at the end of the year. “Lots of funds came back to market that we didn’t expect,” he said.

Among larger firms expected in the market this year are Blackstone, Madison Dearborn, New York-based Clayton Dubilier & Rice and Fort Worth, Texas-based TPG. Those four firms, if they merely equalled what they raised for their previous funds, would alone be targeting more than $45 billion, and they join a growing list of others soon heading back to market (see table, p. TK). Other firms expected to launch funds in 2008 are communications and media LBO shop ABRY Partners, Flexpoint Capital, a Chicago-based buyout group focused on health care and financial services investments, New York turnaround shop Monomoy Capital Partners, Credit Suisse’s captive middle market group DLJ Merchant Banking Partners, and New York-based middle market shop Sentinel Capital Partners.

“What’s really going to be interesting is how mega-funds are going to be doing,” said Probitas Partners’s DePonte, looking ahead to 2008. “Leverage is jammed up. There’s a trend of GPs walking away from deals. How much money does a big fund really need?”

We shall see. One thing’s for certain. As the mega-funds go, so goes the fundraising market.

Josh Payne and David M. Toll contributed reporting for this article.

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: