Firm: Veronis Suhler Stevenson

Headquarters: New York

Leaders: John Veronis, co-founder and managing partner; Jeff Stevenson, managing partner and Co-CEO; John Suhler, founding general partner and president; George Cole, managing director; Hal Greenberg, managing director; Jim Rutherfurd; executive vice president

Strategy: Provides mezzanine financing for new media companies generating $20 million to $30 million of EBITDA on $20 million to $100 million of sales

Number of Investment Professionals: 30

About a year ago,

The turnabout shows how valuable it’s been for diversified shops to have mezzanine funds, particularly today when procuring enough debt for buyout deals is nearly impossible and exit opportunities are scarce.

Accordingly, the New York-based firm is devoting most of its attention these days to mezzanine investments, while putting its buyout plans on the back burner. While already past its $300 million target for

Managing directors George Cole and Hal Greenberg oversee the mezzanine funds, but have all 30 Versonis Suhler Stevenson investment professionals at their disposal. Founded in 1981, Veronis Suhler Stevenson had an investment banking business until 2005, when it decided to concentrate on private equity.

Veronis Suhler Stevenson isn’t the only buyout firm adapting to the market by deploying capital via mezzanine funds.

Typical Deals

Rutherfurd laid out to Buyouts the types of scenarios the mezzanine fund is seeing as well as the types of companies it is pursuing. Typical scenarios include company owners—such as the one discussed above—looking for a minority equity partner; companies that want to refinance debt that is maturing soon or that need to de-leverage; and companies in need of capital to make acquisitions. VSS Structured Capital targets typically generate $20 million to $30 million of EBITDA on $20 million to $100 million of sales.

The types of companies the mezzanine fund looks for are similar to those sought by its buyout fund: profitable Internet companies, subscription-based mobile content providers, for-profit online education and training companies, subscription-based business information providers, niche marketing services companies such as e-mail marketers, and some niche advertising plays, such as digital outdoor advertising providers. In short, new and alternative forms of media.

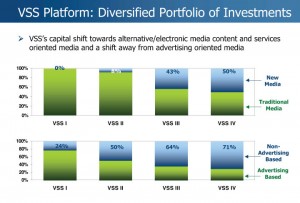

The sectors the firm targets today are much different from the advertising-dependent old-media investments that dominated the firm’s first two buyout funds in the late 1980s and early 1990s. Old media accounted for 100 percent and 92 percent of those funds, raised in 1987 and 1995, respectively, before the percentages fell in Funds III and IV, which it raised in 1999 and 2004–see graph for detail. Rutherfurd said the firm began to shift gears to subscription-driven new media businesses in the late 1990s after observing a steady drop in advertising growth for radio broadcasting, newspapers and other traditional media.

Targets of Veronis Suhler Stevenson buyout and mezzanine funds tend to have built a brand over the years using older forms of media, such as print, before leveraging it into new media. An example from its portfolio on the mezzanine side is TMP Worldwide Advertising & Communications, a recruitment advertising business. Not long ago the company placed 60 percent to 70 percent of advertisements in newspapers and magazines; today, 70 percent of its advertising is placed online. On the buyout side, Access Intelligence LLC, a trade publisher that the firm bought in 2000, used to deliver data to customers in large binders that the company would continually update by mailing more information. Access Intelligence has transitioned to online delivery of its databases.

The firm aims to achieve returns of at least 20 percent with its mezzanine investments through a combination of cash or pay-in-kind interest coupled with warrants, which it has secured in every one of its investments since it raised its first mezzanine fund in 2005. Veronis Suhler Stevenson typically takes about a 20 percent stake in the company, though the fund has owned as little as 2 percent of a company’s equity and as much as 70 percent. The firm can even gain control stakes via its mezzanine fund: In 2006, for example, it teamed with management to buy TMP Worldwide Advertising & Communications from Monster Worldwide for $45 million, which included $20 million of equity and pay-in-kind notes. Veronis Suhler Stevenson is typically the only outside investor involved when investing from its mezzanine fund.

The $123 million

In February, Veronis Suhler Stevenson released a gloomy revised forecast for the media and communications sectors—the first time it has done so in the 22 years it’s published annual forecasts—due to the severe economic downturn. The forecast spelled additional trouble for newspapers, magazines, and television and radio broadcasting. Veronis Suhler Stevenson conducts the annual U.S.-focused forecast to sharpen its understanding of long-term trends in media and communications and to expand its networking relationships in the industry.

Veronis Suhler Stevenson expects overall media and communications spending to drop by 0.4 percent in 2009, rather than to grow by its previous projection of 4.9 percent following an increase of 2.3 percent in 2008. Leading the downward trend, not surprisingly, are the newspaper publishing industry, projected to contract by 16.2 percent in 2009, compared to -13.5 percent in 2008; broadcast television, projected to decline by 9 percent in 2009, versus negative 0.5 percent in 2008; consumer magazine publishing, projected to decrease by 8.5 percent in 2009, compared to negative 6.8 percent in 2008; and broadcast & satellite radio, projected to decline 7.2 percent this year, compared to negative 5.8 percent in 2008. One area for optimism is the professional and business information segment—one the firm’s contemporary segments of focus—which is forecast to be among the fastest growing communications sectors.

Rutherfurd declined to discuss buyout fundraising plans other than to say that it’s nearly impossible to conduct large buyouts, and he doesn’t expect the loan markets to bounce back any time soon. By contrast, he said, “the opportunity to provide [mezzanine] capital is going to be there in good markets and bad markets.”

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: