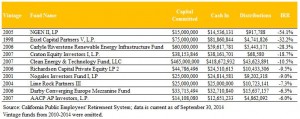

NGEN Partners is the unfortunate leader of the group with its NGEN II LP. The 2005-vintage growth-equity vehicle, focused on the environmental and alternative energy sectors, has generated an IRR of -54.1 percent through Sept. 30. NGEN, which pins the blame in part on regulatory changes in alternative energy, believes there is still an opportunity to improve the performance of the fund. There are two companies left in the portfolio.

Next in line is Exxel Capital Partners with its fifth flagship fund. Exxel Capital Partners V LP is the oldest fund of the list, dating back to 1998, and has generated an IRR of -32.2 percent.

Coming in third with an IRR at -28.3 percent is Carlyle/Riverstone Renewable Energy Infrastructure Fund. The joint fund between The Carlyle Group and Riverstone Holdings was launched in 2006. (The two firms have since parted ways.) Riverstone acknowledged that the fund didn’t pan out as hoped, but noted that the follow-up Carlyle/Riverstone fund, to which CalPERS has far more exposure, is the largest and one of the best performing renewable energy funds out there. Together the funds are successful and in the black, Riverstone said.

In fourth place, with an IRR of -18.7 percent, is Craton Equity Investors I LP, the maiden fund of Craton Equity Partners, which has since been acquired by TCW Group.

Rounding out the bottom five is the 2007-vintage Clean Energy & Technology Fund LLC with a -10.5 percent IRR. It represents by far the largest commitment by CalPERs on the list.

The unweighted average IRR of CalPERS’s active private equity portfolio is 10.9 percent. Since it started investing in private equity in 1990, CalPERS has produced $31.4 billion in profits from its portfolio.

We attempted to reach all the firms appearing on the list of bottom-performing funds for this article. Their comments were incorporated in this story where appropriate.

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: