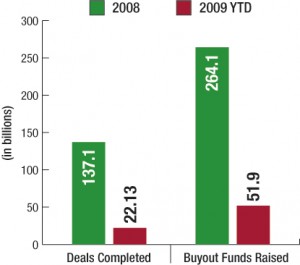

In all, U.S. buyout firms closed a total of 23 LBOs from Sept. 23 through Oct. 13, according to Thomson Reuters, publisher of Buyouts. Combined, the six transactions with disclosed financial terms added up to $11.7 billion and kicked our year-to-date deal volume total up to $22.13 billion.

The largest deal of the period was led by Delphi Holdings’s senior creditors Elliott Management and Silver Point Capital, through which the company acquired nearly all of Delphi Corp’s global businesses in a transaction valued at $10.98 billion.

Other recent deals included the $78 million sale of ATP Oil & Gas Corp’s Gomez Pipelines to energy specialist ArcLight Capital Partners and the $30 million acquisition of internet software developer Microedge Inc. by San Francisco’s Vista Equity Partners.

Fundraising saw some significant performance as well. Mega firm Hellman & Friedman LLC closed Hellman & Friedman Capital Partners VII with $8.8 billion (a lofty sum, though still below its $10 billion hard cap), and Menlo Park, Calif.-based GI Partners closed its third fund, GI Partners Fund III LP, with more than $1.9 billion.

Elsewhere in the market, Atlas Holdings LLC has begun marketing its first traditional buyout fund, seeking to raise $300 million for Atlas Holdings I with Capstone Partners serving as placement agent.

So far in 2009, buyout and mezzanine firms have secured $51.9 billion in capital commitments from investors.

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: