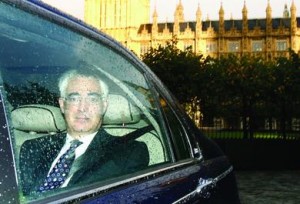

Alistair Darling won few friends in private equity circles this month with his introduction of a flat rate capital gains tax rate of 18% and the scrapping of taper relief. Intended to both simplify a complicated tax regime and increase the tax burden on private equity executives following a year of intense scrutiny over their earnings, the changes have been roundly attacked by pretty much everyone in the industry.

“The changes I propose to capital gains tax also, taken together with the tax loopholes that I am closing, will ensure that those working in private equity pay a fairer share,” Darling said in his Pre-Budget Report to the House of Commons. The issue of fairness has dogged the debate in the press, yet cries from many quarters are arguing it is not fair at all.

“It’s a very peculiar move,” says Mark Owen, director at mid-market firm

It’s a common complaint, one mixed with surprise and annoyance, with an acute awareness that the government appears to be targeting all of what private equity encompasses as it tries to reign in the profits being made by the mega LBO firms. By using what Owen calls a “scatter-gun” approach, the Government has placed a handicap on all private equity, venture and buyouts alike.

“This decision by the Government could have dire consequences for small and medium size businesses throughout the UK. By introducing a flat capital gains tax rate, Darling has effectively removed the tax advantages available to investors who back unlisted companies,” says Gary Robins, CEO of UK private investor syndicate

Tim Green, managing partner at

Mark Spinner, corporate partner and head of private equity at law firm

Andrew Newland, CEO of

As reported in the Financial Times following Darling’s speech to the House of Commons, the large LBO firms, the intended “victims” of the decision, have largely shrugged off the move. “It’s a sledgehammer to crack a nut”, says Owen. “The number of people they were trying to hit, i.e., the bigger private equity bosses, they should have done something much more targeted. If they were trying to target the few, they’ve failed.”

Newland says: “Capital gains tax is such a blunt instrument to use. We need to be extending tax reliefs not destroying them. It is already a struggle to attract high caliber management to early-stage companies, and this is just going to make it even harder.”

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: