Thomson Reuters, the publisher of Buyouts magazine, tracked 113 M&A exits involving U.S.-based financial sponsors in the second quarter of 2013 through June 28, along with 16 sponsor-backed IPOs. The number of M&A exits has increased during this latest period from the 86 reported by Buyouts at the start of April for the first quarter of this year.

Of those 113 M&A exits listed over the quarter, only 28 disclosed valuations for an aggregated total of just over $8.1 billion. The vast majority of deals with disclosed valuations were under the $1 billion mark with only three being valued at $1 billion or more. Among the most prolific M&A exiters during the quarter were 3G Capital Partners, Bain Capital LLC, Kohlberg Kravis Roberts & Co. and Warburg Pincus LLC, which each completing four exits, while Apollo Global Management LLC and The Gores Group LLC participated in three each.

The period’s top deal by value involved an exit by KKR. The New York-based shop sold the SBS Nordic operations of ProSiebenSat1 Media AG to Discovery Networks International Holdings Ltd for an estimated NOK 9.554 billion ($1.7 billion). The media and entertainment company had been seeking a buyer for its radio and television broadcasting stations since October 2010.

Apollo Global Management LLC was a party in the quarter’s second-ranked deal. It received over $1.2 billion for selling the entire share capital of Metals USA Holdings Corp to Reliance Steel & Aluminum Co. The Fort Lauderdale-based wholesaler of processed metal products was sold for $20.65 in cash per share for a total of $770.845 million.

NGP Energy Capital Management LLC took part in the third largest M&A exit of the quarter with the sale of TEAK Midstream LLC to Atlas Pipeline Partners LP. The sale of the Dallas-based provider of natural gas midstream services has been reported to be in cash for $1 billion.

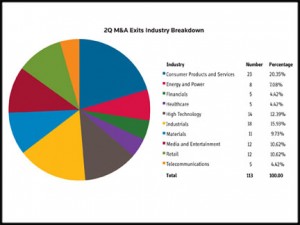

The three largest M&A exits each focused upon a different industry segment. ProSiebenSat1 Media AG is a media and entertainment firm while Metals USA Holdings Corp is in materials and TEAK Midstream LLC is in energy and power. The largest industry segment for M&A exits this quarter was consumer products and services, with a 20 percent market share, or 23 deals. Industrials took a 16 percent market share while high technology was the third largest segment with 12 percent. Retail and media & entertainment tied at 11 percent each, followed by materials with ten percent.

Gone Public

Many buyout shops are opting to take advantage of the strength in equity markets to float IPOs rather than selling their portfolio companies outright. “The IPO market for sponsor-controlled assets has been quite active in the first half of the year and, assuming favorable market conditions persist, we expect the calendar to remain robust throughout the balance of the year,” said Pete Lyon, co-head of the financial sponsors group at Goldman Sachs. “In particular, assets with favorable macro backdrops, such as housing, are being well received.”

Of the at least 16 companies with U.S.-based financial sponsors that went public last quarter, ten are trading above their initial IPO price as of July 2. The companies represent a broad cross-section of industries, with PE-backed financial firms being the most commonly listed. Other industries on the list include fast food restaurants, consumer products, construction services and energy.

The largest IPO completed in the second quarter came from the Oaktree Capital Management LP-owned company Doubleline LLC on April 26. Resulting in a $2.3 billion deal for Oaktree, the Los Angeles-based investment advisory company sold 92 million shares for $25 each. Shares in the company are trading at about nine percent below its IPO price under the ticker of “DSL”.

The fast-casual restaurant chain Noodles & Company went public on June 28 with an IPO size of $96.4 million. Backed by Catterton Partners and Och-Ziff Capital Management Group LLC, the chain of 300 restaurants sold 5.4 million shares for $18 apiece. Since its initial offering, the stock has more than doubled and stood at $45 per share as of July 2. The company has proved particularly popular with college students due to their inexpensive menu of pasta bowls inspired by regional and worldwide cuisine.

Blackstone Group LP’s Seaworld Parks & Entertainment Inc raised $702 million in its April 19 IPO by offering 26 million shares at $27 each. The amusement and recreational facilities company was purchased by Blackstone Group in 2009 from brewing firm Anheuser-Busch InBev and has witnessed increased revenue and profits under private equity leadership. Seaworld is planning to use the proceeds from its IPO to pay down a portion of its debt according to CEO Jim Atchison. Trading under the company ticker “SEAS”, the stock price has increased over 30 percent to $35.70 as of July 2.

Fairway Group Holdings Corporation, parent company of Fairway Market, completed its IPO on April 17 for $177.5 million. The New York-based food retailer is backed by Citibank, CSFB Private Equity Advisers, Sterling Investment Partners Ii LP and Golub Capital Master Funding LLC and sold 13.7 million shares for $18 each. Since its IPO in April, the stock price has doubled to $26.72 on July 2. The company plans to use the net proceeds from its IPO for expansion and general corporate purposes.

Berkshire Partners LLC and Rhone Capital LLC-backed Coty Inc raised $1 billion dollars during its June 13 IPO under the ticker “COTY”. The IPO offered 57.1 million shares in the company at $17.50 apiece. The producer of women’s fragrances raised one of the largest IPOs in consumer product history and was received with healthy investor demand as the shares fell within its expected price range of $16.50 to $18.50.

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: