Private equity firms have expressed interest in taking over part or all of

The banks advisers,

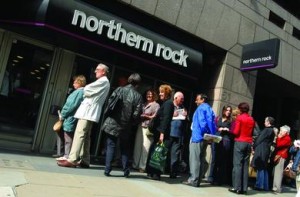

On Monday, the beleaguered lender said that these possible offers valued the existing equity “materially below the market price at the close of business on16th November”. This sent shares in the group plunging as much as 21% to record lows of 104p. The shares sank even further on Tuesday, touching 60p at one point.

This latest slide was prompted by comments from the Chancellor of the Exchequer in the House of Commons on Monday afternoon.

The Treasury said that it would be looking at any proposals submitted but warned that purchasers “should not assume that the current Bank of England loan facilities will be available beyond either any sale or the expiry of the facilities in February.”

The Government could technically breach EU rules governing state aid, if such support for troubled companies extends beyond six months.

It is believed that Alistair Darling, the Chancellor, will also consider nationalising the bank and could veto other proposals.

Virgin is backed by US insurer AIG, US private equity firm WL Ross, UK hedge fund manager Toscafund, and HK investment house First Eastern Investment Group.

Arnold’s consortium, under the

Another bidder,

A spokesman Northern Rock said the bank has started “discussions with a number of selected interested parties to clarify their proposals”.

It added that one of these was a possible offer for the whole company “materially below the market price at the close of business on Tuesday, 20 November”. This is widely believed to be JC Flowers’ offer.

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: