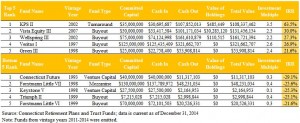

Connecticut’s best performer was KPS Capital Partners’s second special situations fund. The 2002-vintage has generated an astronomical 63.5 percent IRR for the state and an equally impressive 3.5x investment multiple. After the turnaround fund, buyout funds filled out the next top four. The leader among them was the 2007-vintage Vista Equity III. Vista Equity Partners’s third flagship vehicle has posted a 30 percent IRR and 2.5x multiple for the state. Coming in third was Wellspring Capital Partners III. The New York-based firm’s third primary fund sports an IRR of 27.3 percent along with a 2.2x investment multiple.

On the other side of the coin, the 1993-vintage Connecticut Future Fund did not return much on its investment. The venture fund’s -29.1 IRR was the lowest of the portfolio. It was followed by Forstmann Little & Co.’s seventh mezzanine fund from 1998. Forstmann Little VII generated a -25.6 percent IRR and 0.4x multiple. Keystone Ventures produced the third-lowest IRR with its1998-vintage fund. The Philadelphia-based Keystone Ventures’s fifth fund had generated an IRR of -25.3 percent and a 0.1x investment multiple as of year-end.

The state began constructing its private equity portfolio in 1987. Overall, it has a total value approaching $9.6 billion in its entirety. As of December 31, 2014, the pension’s active funds had drawn down total of $6.6 billion and returned $6.9 billion in distributions, $632.2 million in 2014 alone.

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: