The former city banker was criticised by politicians and union leaders for not going far enough in his proposed regulation of the industry.

Brendan Barber,

While Paul Kenny,

He said: “Walker’s proposal that parts of the financial sector should police itself is a non-runner and his view that the disclosure requirements on public companies are too onerous is strangely divorced form reality”.

John McFall, chairman of the UK Treasury Select Committee, which grilled a number of private equity executives in the summer, also accused Walker of a ‘softly softly’ approach. The committee is due to meet with Walker on December 11th to commence the next phase of its inquiry into the industry.

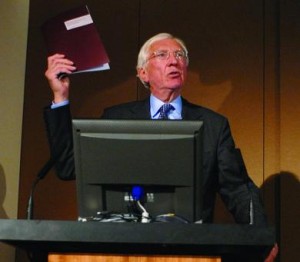

Responding to these criticisms yesterday Walker said: “It disappoints me that the chairman of the Treasury Select Committee says that these guidelines are not enough. I have set out why a voluntary approach is the right approach. If a voluntary approach does not prove to be enough it is possible then to move to primary legislation. But if you start with primary legislation you can not move back to voluntary.”

“Also, to start with primary legislation would be a very negative route. These are cross border international businesses run by very smart individuals and black letter legislation would make the UK very unattractive. We do not want these practices forced on other countries but instead emulated by them”.

He argued that not only was a ‘comply or explain’ approach more appropriate for situations where disclosure could put a company at an unfair competitive disadvantage, but that ‘peer group pressure’ and threatened expulsion from the BVCA would be enough to force buyout houses to comply when necessary.

With regards to the disclosure of compensation and fees generated by buyouts firms, he reiterated what he said in July when he published the preliminary report. “GPs and owner LPs have their own arrangements for compensation disclosure, which LPs are broadly happy with. It is not a matter for the public, the media or politicians”.

Walker was also accused more specifically of diluting proposals made in his preliminary report under pressure from the industry, in particular those involving the publication of annual reports and ‘attribution analysis’ by GPs, detailing exactly how they generate their returns. Walker is accused of extending the time frame required for the publication of annual reports, and of introducing industry wide attribution analysis, taking the onus off individual GPs to do this.

He said: “I am not conscious of watering down proposals – these are the same provisions I made in the guidelines. GPs will have to keep their websites updated with details of their portfolio companies and who is responsible for them as well as the composition of their latest funds. Several GPs will publish annual reviews in the short term and I am confident we will see more in the longer term”.

With regards to attribution analysis Walker explained: “When I approached the industry it was extremely wary of this. Most GPs argued that conceptually it could not be done. So I decided that it would be irresponsible and of no help if I required each GP to do its own attribution without a standard template which we are in the process of building- otherwise we would have incomparable data. It is not a dilution.

“The BVCA will collect this data from funds to enable attribution analysis for the whole industry – the priority here is the promotion of understanding. If private equity firms were to do this individually and not anonymously thorough a standard template they would try to put their best spin on it”.

A full copy of the report can be found at www.walkerworkinggroup.com.

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email:

If you do not receive this within five minutes, please try and sign in again. If the problem persists, please

email: